How to claim your grant

How to claim your grant, what evidence you need to submit with your claim and what happens next.

Claim deadlines

We must receive your claim by midnight on 31 October 2022 or your grant award will be withdrawn.

How to claim

Your grant will be paid in a single payment in arrears. You should submit your claim as soon as possible after you have paid for, taken delivery of, installed and made operational (if required) all of the Items on your GFA.

If you have any queries when preparing your claim, please contact [email protected] or call us on 03000 200 301 and select the option for the Farming Equipment and Technology Fund.

You will get an email to acknowledge receipt of your claim. It is your responsibility to make sure that we receive your claim before the deadline. If you do not receive an email to acknowledge receipt, then you should re-submit your claim or contact us for help.

Buying your Items in full, before you receive your Grant Funding Agreement will invalidate your application, and it will be rejected.

Please submit the following with your claim:

-

a completed claim and declaration template - you will have received the claim template at the bottom of your GFA email

-

copies of the invoices requirements are detailed below

-

copies of your payment evidence - bank or building society statement or business credit card statement to show the Items have been paid in full, requirements are detailed below

-

photographic evidence, showing the equipment in situ and operational, for each Item, requirements are detailed below

-

Evidence that each Item contains the required CE or UKCA marking, see the ‘What the grant is for’ section. This needs to be a photograph of the manufacturer’s plate showing the marking, or a scanned image of the Certificate of Conformity from the installation or Operating Manual

-

Serial number of each Item. This needs to be a photograph of the manufacturer’s plate, or a scanned image from the Installation or Operating Manual, showing the serial number

-

Installation and Operating manuals maybe also requested to help verify the Item is eligible.

These should be either photographed or scanned and emailed to [email protected] by midnight on 31 October 2022. The email must be submitted from the email address registered in the Rural Payments service. If you are unable to send electronic copies of your invoices or statements, please contact us for a postal address to send them to.

You can save your documents on your home computer anywhere you choose but we cannot accept links to documentation that are saved via file hosting services for example Microsoft OneDrive, or saved to the Cloud (storing and accessing data and programs over the Internet). So please send your documents to us as file attachments.

Where you have made a straightforward mistake on your claim (and it is obvious from a simple administrative check of the claim), you can ask us to correct it. We may be able to do this without consequence.

All correspondence about your FETF claim will be sent from [email protected]. You should add this email address to your trusted senders list and remember to check your spam and junk mail folders.

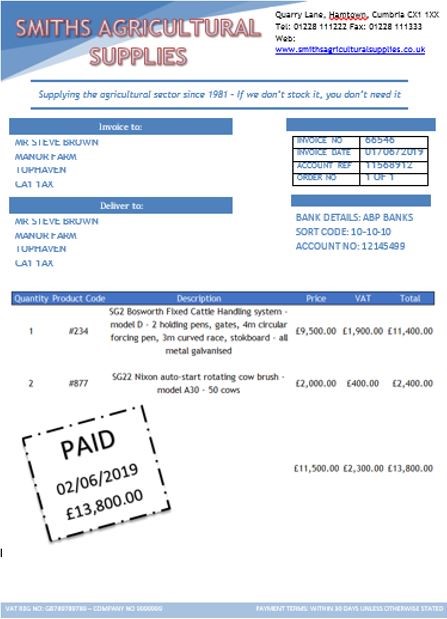

Invoices

To be accepted, invoice(s) must:

-

individually describe each Item in full

-

breakdown the cost of each Item

-

detail the manufacturer’s make and model of the Item purchased

-

ideally quote the relevant FETF Item code from Annex 3 of this manual against the Item purchased

-

be addressed to the same individual or business as detailed in the GFA email

-

show the supplier’s name, address, VAT number and date

-

be from a supplier who is not part of, or linked in any way to, your business

Here is an example of what an invoice should look like:

We will only pay grant for those Items that we agreed to fund, based on your GFA. If the invoice includes additional Items that are not part of your FETF application, you must clearly Itemise and highlight the Items you are claiming for. We will accept an account statement from the supplier, rather than all the additional invoices.

Invoices must be paid in full and the payment must have left your bank or building society account before you claim your grant funding. If you have made a payment to a supplier that covers more than one invoice, you need to provide copies of all the invoices included in the payment.

The grant is paid in a single payment in arrears. It can only be claimed after you have bought, paid for, installed and made operational (if required) all the Items on your GFA, and all Items need to have been bought after the date the approval e-mail was sent to you. If however, you are struggling to get all your Item please see Section - Unable to get your Item.

Spend will be considered eligible where:

-

the Items are listed in your GFA approval email

-

the Items meet the minimum specification set out in Annex 3 of this manual

-

the spend is incurred after the date of the GFA approval email

-

the Items have been fully paid for by your business. This means payment for the Items is shown on your business bank or building society account statement or on your business credit card statement

-

Items have been delivered, installed and are in use by your business

-

Items are at the location stated in your application

-

the Items are new. Ex-demo, second hand, part exchange and ‘try before you buy’ Items are not eligible.

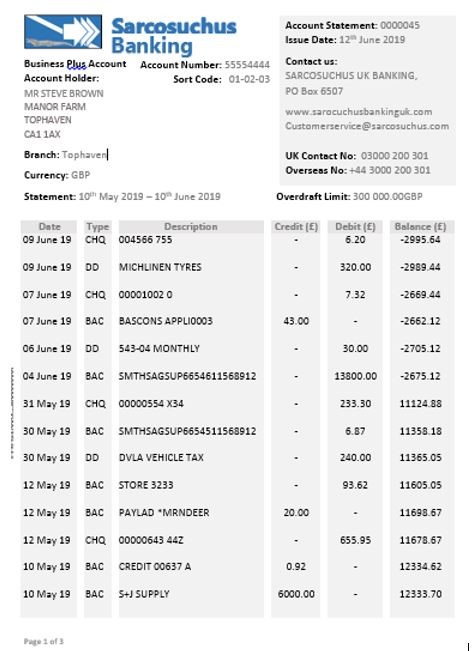

Payment evidence

You will need to send us copies of your bank or building society statement or business credit card statement so that we can check all invoices have been paid in full by your business. For cheque or BACS payments, the cheque number or transfer reference should be visible on the statement. Acceptable evidence includes screen shots from an online account showing payment details and bank or building society logos, or a certified report printed from a banking system.

You can blank out other personal information that isn’t needed, but bank or building society statements must still clearly show:

-

bank or building society’s name and logo

-

account holder name in full

-

account number

-

sort code

-

transaction date

-

transaction type (including payee ref/cheque number)

-

transaction amount

Here is an example of what a bank or building society statement should look like:

If other payments were included in the BACS transaction, we will need to see an additional BACS breakdown report for BACS payments to make sure a full audit trail is visible.

You must not make cash payments for any grant funded Items as there isn’t a satisfactory audit trail, and we will not be able to pay any of your grant.

If you pay for any Items with a credit card, the Items must be purchased from your business credit card, not a personal account or a different business account. The credit card statement(s) must show that all invoices for grant related Items have been paid in full by your business.

If any other credit card is used you must provide evidence to show that the Item ownership has been transferred, by paying back the amount before a claim is made. For example, if you pay £4,000 for an Item from your personal credit card, you should pay £4,000 off your personal credit card from your business bank or building society account. You will need to submit both the personal credit card and business bank or building society account statements to show this.

If you pay for an Item through a buying group, please provide evidence to show you have paid the intermediary (Buying Group). The intermediary must also evidence that payment has been made to the supplier. This can either be an email from the supplier or a supplier statement, for example, there must be evidence to show that you have paid the intermediary, and the intermediary has paid the supplier.

You won’t be able to use lease purchase or hire purchase to buy any of the Items in your application as your business will need to have fully paid for all Items (with the funds having left your bank or building society account) and own the Items outright.

It is your responsibility to provide information securely. If you wish to password protect email attached documents, you should contact us before sending. That way, we can confirm the method being used is acceptable. We will store your information securely for seven years as per the terms and conditions of grant. This is in line with our document retention policy.

Photographs

Your claim must be supported with photographs of each Item which must:

-

show the Item specification and the Item in situ and working (not a representation of the Item from a supplier).

-

be clear, in focus, in colour and clearly show the Item, and with no other objects in front of the Item

-

include make and model number, to show the eligibility of the Items against the specification in Annex 3

-

not be smaller than 600 x 400 pixels and ideally the image file size no larger than 400 KB

-

clearly demonstrate the layout of the system (for Handling Systems FETF 56 Mobile Cattle Handling Systems, FETF57 Fixed Cattle Handling Systems, FETF69 Mobile Sheep Handling Systems, FETF70 Fixed Sheep Handling Systems and FETF 76 Fixed Handling System for Pigs)

Avoid taking photos which identify individuals including employees unless you have obtained their permission to share their personal information with us. Contact us for more information.

Here is an example of what photos should and shouldn’t look like:

If you are unable to send electronic copies, please contact [email protected] or call us on 03000 200 301 and select the option for the Farming Equipment & Technology Fund.

Installation and Operating manuals

As part of the claim process, you may be asked to provide a copy of the installation and operating manual for Items you have purchased to help verify the Item is eligible. You should provide these in an electronic format.

Unable to get your Item?

If you are having difficulties obtaining an Item(s), please let us know as soon as possible by emailing [email protected]. You will have to make the request in writing and provide evidence in support.

You will need to tell us the make and model of the Item and the supplier(s) you have tried to source the Item from.

We may agree amendments to your GFA based on the following exceptional circumstances:

-

You have applied for two Items but realise you can buy them as a single Item for example you order a cattle crush and you find that the “add on” such as a head scoop already comes with it.

-

It is clear to us you have selected the wrong Item or added the incorrect quantity at the time of application for example you wanted a heat and service detector and have selected a calving detector instead.

-

If you experience supply issues and have received confirmation that the supplier is unable to supply the Item before the deadline. Please note, you must make every effort to source the Item(s) from alternative suppliers or provide evidence from your supplier confirming your order date and the reason for delayed delivery.

-

Unexpected event for example shipping containers delayed or returned to country of origin by customs.

-

Found Item to be not compatible with existing Items or technology; for example, the Item requires an internet signal to work and there isn’t one in the location of the Item.

We will consider amendment requests on a case-by-case basis, but by removing an Item your application must still be within the minimum (£2,000) and maximum (£25,000) grant values. The revised total amended score still needs to be above the cut off score for the round. See section - Scoring and checking your application

Requests to add new additional Items will not be considered. You will need to apply for the Item in a future round of the FETF. You can apply for funding over multiple rounds up to a maximum of £50,000 of grant in total from the scheme.

Incorrect claim

You must make sure that you only claim for the Items in your GFA.

You must buy Items that meet the required specification and the invoices you submit must be clearly Itemised and dated.

Your claim will be considered incorrect and will be rejected if:

-

your claim was submitted after the deadline

-

you have not bought all of the Items listed in the GFA

-

you buy any Items of the wrong kind or which do not meet the minimum specification

-

you have ordered Items before the application window opened

-

you have bought Items before the GFA was sent to you (excludes refundable deposits)

-

the supporting evidence that you provide with your claim does not meet the requirements set out in this manual

-

you made cash payments for any of the Items

-

you used lease purchase or hire purchase

-

you bought ex-demo, second hand, part exchange or ‘try before you buy’ Items

-

you have bought your Items from a supplier who you/your business are part of or linked to in any way.

Withdrawing your claim

You can withdraw your claim at any time unless:

-

you have already been told about an error in the claim

-

you have been told about a future site visit or have already had a site visit

-

a site visit reveals a breach of the rules

If you wish to withdraw your claim, please email your request to [email protected] as soon as possible, telling us your reasons for withdrawal. You should include your FETF reference number.

Payment of your grant

Grant funding is paid directly into the bank or building society account attached to your business’s main SBI number registered in the Rural Payments service.

It is your responsibility to make sure a valid and active bank or building society account for your business has been added to the main SBI before sending us your claim evidence. Failure to do so will result in your claim payment being delayed. If you need to add a bank or building society account to your main SBI, contact the helpline on 03000 200 301 and follow the options for the Rural Payments team.

We aim to pay your claim as soon as possible either within 30 working days of receipt of your claim evidence or within the agreed published timescales for the claim submission window. If there are any issues, it may take longer. You may need to account for this if it will affect the cash flow of your business.

Site Visits

Your claim for grant funding may be selected for a site visit before the grant payment is made, or up to five years after this date.

All the details in your application, your claim and the declarations you make when submitting your application and Items will be checked at visit. This will include a check on the dates on which the Items were bought, who the invoice or invoices were made out to and the specification of the equipment.

Reductions

If you breach the terms of your GFA, the terms and conditions set out in Annexes 1 and 2 of this guidance, or you do not meet the relevant eligibility criteria for this fund, your payments may be reduced or withheld. Any grant previously paid may be recovered.

In serious cases we may terminate your agreement and/or prevent you from receiving other grants.

After you receive your grant

Items purchased with grant funding must be kept at the location stated in your GFA, operational and in good repair. They must be used for the same purpose as set out in the original application, for five years from the date of the grant payment. We may recover some or all the grant if you breach the grant funding agreement during this period.

You should record the Items on the business’s asset register and keep it for a minimum of five years from the date your claim is paid. You should also keep copies of any relevant documentation during this period. This includes original invoices, receipts and bank or building society statements.

You must allow officials authorised by the Secretary of State for the Department of Environment, Food and Rural Affairs, Rural Payments Agency and anyone accompanying them, to inspect the equipment at any reasonable time within the five-year period from the date of the final payment of your grant.

You must tell us in advance of:

-

replacing or upgrading any of the grant funded Items

-

any changes in the ownership of the business that applied for grant

-

any changes in the ownership of the grant funded Items

-

the business or grant funded enterprise/activity ceasing to trade or fundamentally changing the nature of its activities

If any grant funded assets are sold, become redundant, or will no longer be used for the purpose for which they were grant funded, the grant will be recovered pro-rata. This will be effective for five years from the date of your grant payment.

If the business changes ownership, the Item can either transfer to the new owner or the grant can be repaid to us. You must contact us before any changes occur.

All invoices, receipts and accounts, and any other relevant documents relating to the grant must be kept for at least five years form the date of the final payment. If you have any other queries, please contact [email protected] or call us on 03000 200 301 and select the option for the Farming Equipment & Technology Fund.

Publicity requirements

The Agreement holder shall comply with all instructions and manuals from the Authority in relation to acknowledgement and publicity of the Grant, including using any materials or templates which are provided to it for this purpose. Such acknowledgement and publicity may include, where appropriate, a statement on any website operated by the Agreement holder for business purposes.