Income loss recovery scheme for Home Office police forces

Guidance for Police and Crime Commissioners on how to access the income loss recovery scheme for lost sales, fees and charges as a result of COVID-19.

Background

What is the scheme?

1. COVID-19 has had an impact on Police and Crime Commissioners (PCCs) and their equivalents’ (the Mayor of Greater Manchester, the Mayor of London and the City of London Corporation) ability to generate revenues in several service areas as a result of lockdown, government restrictions and social distancing measures related to the pandemic. This new one-off income loss scheme (the scheme) will compensate for irrecoverable and unavoidable losses from sales, fees and charges income generated in the delivery of services in the financial year 2020/21.

2. The scheme will involve a 5% deductible rate, whereby authorities will absorb losses up to 5% of their planned 2020/21 sales, fees and charges income, with the Government compensating them for 75p in every pound of relevant loss thereafter. By introducing a 5% deductible the Government is accounting for an acceptable level of volatility, whilst shielding forces from the worst losses.

3. The definition of an eligible loss is one that meets the principles set out in paragraphs 13 – 15 of this guidance.

4. Data collection exercises will be used to collect information on relevant losses from all 43 Home Office (the Department) forces in England and Wales, and this will be done three times throughout the year.

Explaining the parameters

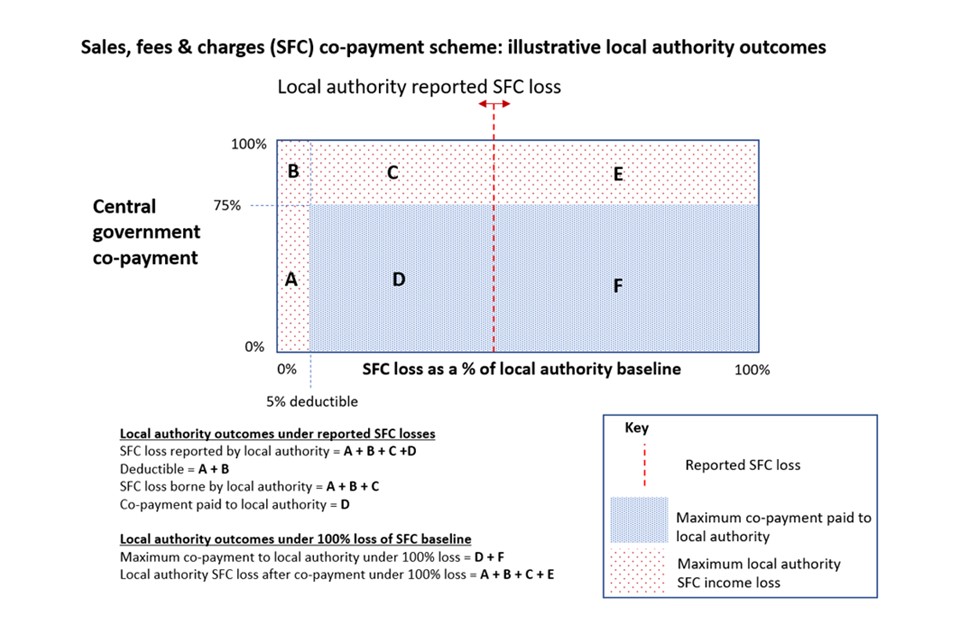

5. The amount a PCC can be expected to receive through the scheme will be calculated by a set of parameters. The parameters are set out below and are identical to those set by the Ministry for Housing, Communities and Local Government to calculate income loss recovery to local authorities illustrated at Figure 1 below. The following formula can be used to understand the parameters in more detail:

6. The baseline [X axis of figure 1] – The gross income that a PCC budgeted to collect in relation to relevant income streams at the start of the year which should be directly linked and reconciled to the published balanced budget set by the PCC.

7. The deductible [A + B in figure 1] – An amount equivalent to 5% of budgeted income from eligible sales, fees & charges losses included in a PCC’s claim will be deducted from the losses claimed for, which PCCs will be expected to absorb.

8. The co-payment rate [D in figure 1] – Thereafter there will be a cost splitting arrangement where 75% of relevant losses will be compensated for by government, with the remainder being met by PCCs, up to a maximum of the baseline in paragraph 6.

Figure 1

Figure 1 illustrates the parameters of the scheme. It reflects the outcomes for local authorities, which this scheme mirrors for police forces. It demonstrates the compensation received from government depending on the loss of income. Presented as a graph it has a horizontal axis displaying the loss of income and a vertical axis displaying the percentage of central government funding that will be received. Lettered blocks demonstrate the way funding is distributed via the scheme.

If there has been a 100% loss of income, the graph shows that a local authority would firstly see a 5% deduction of budgeted income (block A + B). Then the local authority would receive compensation for 75% of the relevant losses (block D + F). The local authority would bare the remaining 25% of losses (block C + E) in addition to the 5% deduction (block A + B).

The graph also shows if there has been a loss of income lower than 100%, a local authority would firstly see a 5% deduction of budgeted income (block A + B). Then the local authority would receive compensation for 75% of the relevant losses (block D). The local authority would bare the remaining 25% of losses (block C) in addition to the 5% deduction (block A + B).

Eligibility

9. The scheme is open to all 43 PCCs and their equivalents in England and Wales that have incurred relevant income losses.

Scope of the scheme

What income losses can be claimed for under the scheme?

10. The scheme will compensate PCCs for eligible losses of income from sales, fees and charges which they had forecast to collect through the usual delivery of services in 2020/21. This guidance sets out principles for determining whether losses are eligible. The principles-based approach acknowledges that individual PCCs will be best placed to determine what losses from their forecast income are within scope of the scheme as set out in the guidance.

11. All claims for compensation under the scheme must comply with the principles set out at paragraphs 13 to 15 of this guidance, and this must be certified by the force’s PCC or equivalent.

12. The Department may require forces to provide evidence to support claims and may make any payments conditional on such evidence being provided. Grant paid out by the Department may also be requested back by the Department and required to be paid back, if it becomes clear that a PCC has not complied with the principles included in this guidance. More details of this are set out in the ‘operating the scheme’ section of the guidance.

The principles defining relevant losses

13. Principle one: The income is transactional income from customer and client receipts (excluding commercial and residential rents and investment income), which is generated from the delivery of goods and services and which was budgeted for in 2020/21:

- Revenues that are collected in exchange for a good or service where demand has been reduced because of COVID-19, including budgeted management fee income.

- Income collection must be directly linked to the delivery of goods and/ or services and must be categorised as such when submitting the data return.

- Income from traded services which generate the same types of income could be eligible where the losses meet the principles. However, commercial investment revenues and rental income are not eligible losses and will not be compensated for under this scheme.

14. Principle two: As a result of COVID-19, and consequent reductions in economic activity, this income has been unavoidably lost and will not be recovered in this financial year:

- This principle is intended to apply where reductions in economic activity because of lockdown and social distancing restrictions directly lead to lost revenues.

- “Unavoidably lost” means that factors outside of the force’s control caused the loss to be incurred. Voluntary decisions, which were made locally, and which were not aligned to relevant government guidance at the time, are not covered by this (e.g. closure of services by choice rather than because of government guidance). PCCs should use their judgement to determine whether a voluntary decision was made with the intention of supporting relevant government guidance, or whether it represented a departure from guidance in place at the relevant time. These judgements will be in scope of the assurance processes referred to in this guidance and will be subject to a targeted quality assurance process to ensure claims and interpretations of unavoidably lost income are in line with the guidance.

- “Will not be recovered in this financial year” means that, at the point of claim, the income is irrecoverable and will not be collected before 31 March 2021. Deferred income meeting other principles, but which can be recovered within this year, will not be compensated for. The end of year reconciliation process will ensure that only irrecoverable losses are compensated for.

15. Principle three: Compensation will be based on net losses. Where a PCC has been able to reduce expenditure, or has received other compensation, compensation will only be provided for the residual loss.

- Compensation will be provided to mitigate the net budget gap which irrecoverable service income losses have created in the PCC’s balanced budget set before the start of the year. Where possible, PCCs should have taken action to mitigate the impact of losses, e.g. by reducing expenditure such as stock purchases or running costs.

- If other government funding has been provided in relation to specific (e.g. other emergency government grant, or furloughing staff) it should also be netted off as this would have contributed to closing the net budget gap in the relevant service area.

- Where possible, the temporary reallocation of employees to deliver other services which have been supported by emergency grant funding should be appropriately accounted for as a net saving in the service that the unfunded income loss relates to. This is in order to identify and compensate for the net pressure the loss of income has had on the PCC’s budget.

What isn’t eligible

16. Income losses which are not covered by the principles, and so which are outside the scope of the scheme, include:

17. Investment income

- Income losses resulting from investments are not eligible, as they are not transactional income (principle one). This covers all of the financial assets of a force as well as other non-financial assets that the force holds primarily or partially to generate a profit/surplus (e.g. investment property portfolios and investments that are managed as part of normal treasury management processes).

- Other commercial income such as from advertising, is outside the scope of the scheme (principle one).

18. Rental income

- Rental losses are not eligible, as they are not transactional income (principle one).

19. Compensation paid to third parties for loss of revenue

- Some services are contracted out, such that the force does not directly deliver the service.

- In some cases, forces subsidise services either directly or through a management charge. These PCCs may have seen an unplanned increase in this budgeted expenditure because of COVID-19, which may be irrecoverable. This additional spending would not be in scope of the scheme, as the subsidisation of services through increased payments does not represent a loss of income to the force (principle one).

- In other cases, forces are making additional payments to a) ensure the wider sustainability of providers and/or b) support the extra costs of providing services in a COVID-19 compliant way. These payments would not be in scope of the scheme as they do not represent a loss of income (principle one).

20. Income which was not included in the PCC’s general fund budget for 2020/21

- For a loss to be eligible under the scheme the PCC must have a related budget amount built into its general fund revenue budget for 2020/21. Any other income losses (e.g. losses incurred directly by a force owned company) will not be eligible (principle one).

- If a service is transferred back to the force during the year this will not be covered under the scheme on the basis that it did not form part of the PCC’s budget at the start of the year (principle one).

21. Income that can reasonably be recovered later in the financial year

- Where a force knows that it can recover a loss within the financial year, the Department expects the PCC to take reasonable steps to recover that income and that loss will not be eligible (principle two).

- However, the Department acknowledges that forces may not yet know whether some of these income losses may be recoverable. As such, PCCs may claim for a loss if they have a reasonable basis to believe that recovery is unlikely (principle two).

- A reconciliation process (paras 25 – 27) will be carried out after the end of the financial year, and any grant paid in respect of losses that were ultimately recovered will be repayable to the Government.

22. Income losses which can be mitigated by reductions in expenditure, or which have already been compensated for by other government funding

- Whilst a reduction of service delivery may have led to a loss in income, it may have also led to some savings in planned expenditure. Where this is the case, PCCs should only claim for the net loss. This will mean that the income scheme only funds the net budget pressure in relation to the service – (principle three).

- In the data collection exercise PCCs will be required to give the Department a detailed account of the steps they have taken to reduce associated expenditure, and if that has not been possible, why that is the case.

Operating the scheme

Period covered

23. The scheme compensates eligible authorities for irrecoverable losses compared to budgets that have been set for the period from 1 April 2020 to 31 March 2021.

Schedule of payments

24. This guidance supports the data collections which will be used to collect and calculate the compensation that each PCC will receive under the scheme. The schedule of data collections is planned to be as follows (subject to change):

| Release of data collection and payment | Period of loss covered |

|---|---|

| October 2020 data return (intended payment December 2020) | 1 April 2020 - 31 July 2020 |

| December 2020 data return (intended payment January 2020) | 1 August 2020 - 30 November 2020 |

| April 2021 data return (intended payment May 2021) | 1 December 2020 – 31 March 2021 |

Reconciliation

25. All payments made under this scheme will be subject to a reconciliation process after the three data collections and payments have been conducted. This is necessary because the full picture on some losses may emerge over time and some losses claimed for in the early part of the scheme may ultimately be recoverable, and others might ultimately be irrecoverable when recoverability was originally considered possible.

26. This process will therefore be compulsory for any PCC who has accessed compensation under the scheme throughout the year. It will ask for information which will calculate the actual losses over the course of the whole year. This will be reconciled against payments made to ensure that the correct level of compensation has been awarded to each PCC. Further details on this process will be set out in due course. The reconciliation may potentially be combined with the final payment.

27. Any PCC which does not comply with the reconciliation process, which will form part of the grant conditions, will be required to pay back any grant that has been awarded to the PCC under the scheme. Any excess grant that has been paid, where losses were recovered later in the year will also be repayable to the Department.

Local responsibility for validating losses

28. Individual PCCs will be responsible for making sure that the claims they make under the scheme meet the principles set out above. For each return, the PCC must certify that the claim is accurate, reasonable, and made in accordance with the principles.

The department’s assurance process

29. Payment of grant will also be conditional on the accuracy and reasonableness of the claims made. The Department may require PCCs to provide evidence to support their claims. Where the Department requires such evidence, grant payments will either not be made until the relevant evidence has been provided or will be clawed back and repaid by the [PCC/relevant force] if a payment has already been made.

30. PCCs may also be required to provide evidence on the basis of random sample checking, or on the basis of potential discrepancies identified by the Department once submitted claims are made.

31. Failure to supply evidence to the Department could result in a grant payment not being paid. Where the Department is not satisfied that a PCC’s claim has been made in accordance with the principles it will not pay those parts of the claim that it considers to be outside the scope of the principles. If payment has already been made this may be clawed back and repaid by the PCC/relevant force].

32. PCCs may choose to engage their internal auditors to provide review and challenge on the appropriateness of the claims that are submitted in line with this guidance, and the Department would consider relevant internal auditor reviews as appropriate evidence in its the assurance processes.

Contacts

33. PCCs or finance officers should contact Gary Ridley at Durham Constabulary if they have any queries regarding the scheme by using the following email address: [email protected]

34. This guidance will be kept under review and may be updated with each scheduled data collection/payment throughout the duration of the scheme.