Record keeping (VAT Notice 700/21)

Find out what records you must keep and how to keep them if you're registered for VAT.

1. Overview

1.1 This notice

This notice gives guidance on the records you must keep if you’re registered for VAT. It also tells you how best to keep these records.

Further information is also available in VAT guide (Notice 700).

1.2 Changes to this notice

The changes to this notice are to:

- correct out of date information

- add information about digital record keeping that was previously published in Notice 700/22

1.3 Requirements for other taxes

This notice explains the record-keeping rules for VAT. Many records kept for VAT purposes will overlap with records for other taxes, but the detailed rules as well as the retention periods may differ.

1.4 Checking your records

From time to time we’ll visit you, usually at your main place of business. We’ll normally specify which records we want to see ahead of a visit and those records must be available.

You can find further information on general compliance checks in factsheet CC/FS1a.

2. Record-keeping rules for all VAT-registered businesses

2.1 Records you must keep

The basic rule is that you must create and keep normal business records. You do not have to keep records in a set way and most bookkeeping and computer systems will meet this requirement. Records that form part of your ‘electronic account’ must be kept digitally in functional compatible software.

Apart from keeping business records and the special requirements, we ask that your records:

- are complete

- are up to date

- allow you to calculate correctly the amount of VAT that you have to pay or can claim from us

2.2 Special records for VAT

There are 2 records that are specifically required for VAT. These are:

- the VAT account — in many cases this will based on a routine business record of VAT you owe or can claim — if you are required to keep digital records then these will be your electronic account

- a VAT invoice for supplies to other VAT-registered businesses — a ‘VAT invoice’ is just the term for an invoice which contains some information required by the VAT rules — most commercial invoices will already hold the right information

2.3 Business records

VAT law requires you to keep all your business records. Our view of business records is wide and will include:

- annual accounts, including profit and loss accounts

- bank statements and paying-in slips

- cash books and other account books

- credit or debit notes you issue or receive

- documentation relating to dispatches and acquisitions of goods to or from the UK or EU member if you are registered in Northern Ireland or relating to dispatches and acquisitions made before 1 January 2020 if you are registered in Great Britain (England, Scotland and Wales)

- documents or certificates supporting special VAT treatment such as relief on supplies to visiting forces or zero rating by certificate

- import and export documents

- orders and delivery notes

- purchase and sales books

- purchase invoices and copy sales invoices

- records of daily takings such as till rolls

- relevant business correspondence

- VAT account (electronic account)

What a business record is will depend on the type of business you run. You’ll always have to keep a VAT account and copies of invoices, but some of the other records may not be a normal record in your business. If that’s the case you do not have to keep such a record just for VAT. Some businesses will create additional business records and these must be kept and produced to HMRC when you’re asked.

2.4 Keeping records

Generally, you must keep all your business records for VAT purposes for at least 6 years. Records that you use for other tax purposes may need to be kept for longer periods.

If the 6-year rule causes you serious storage problems or undue expense, or you need advice on records for other types of tax, then you should consult VAT general enquiries. We may be able to allow you to keep some records for a shorter period.

3. VAT invoices — the basics

3.1 Explanation of a VAT invoice

A VAT invoice is the term for an invoice which contains some information required by the VAT rules. Most commercial invoices will already meet the requirements.

Only VAT-registered businesses can issue VAT invoices and if you’re VAT-registered, you must issue a VAT invoice whenever you supply standard rate or reduced rate goods or services to another VAT-registered person. Normally you must issue a VAT invoice within 30 days of the date you make the supply.

3.2 Importance of VAT invoices

The VAT invoices you issue form a very important part of your business records and you must keep a copy of every VAT invoice you issue.

The VAT invoices you receive are the primary evidence for you to recover VAT you have incurred as input tax and you should make sure you keep them in a way that allows you to find them easily when asked.

VAT invoices are crucial to your business customers because the VAT invoice is the primary evidence that’ll allow them to recover the VAT you’ve charged.

3.3 Issuing invoices electronically

Electronic invoicing offers many advantages over paper invoicing. Electronic transmission of documents in a secure environment can make sure of:

- structured data for effective auditing

- improved traceability of orders

- reduction in paper documents, which can reduce storage and handling costs

- quick access and retrieval

- improved cash flow

- security and easier dispute handling

See Electronic invoicing (VAT Notice 700/63) for information on the rules which apply to electronic invoicing.

4. VAT invoices — detailed rules

4.1 Details to include on a VAT invoice

You must show the following details on any VAT invoices you issue:

- a sequential number based on one or more series which uniquely identifies the document

- the time of the supply

- the date of issue of the document (where different to the time of supply)

- the name, address and VAT registration number of the supplier

- the name and address of the person to whom the goods or services are supplied

- a description sufficient to identify the goods or services supplied

- for each description, the quantity of the goods or the extent of the services, and the rate of VAT and the amount payable, excluding VAT, expressed in any currency

- the gross total amount payable, excluding VAT, expressed in any currency

- the rate of any cash discount offered

- the total amount of VAT chargeable, expressed in sterling

- the unit price

Special rules apply to invoices issued under a margin scheme or subject to a reverse charge. You need to follow the rules for such supplies.

4.2 Invoices to EU member states from businesses based in Northern Ireland

If your business is based in Northern Ireland and you send an invoice to a person in an EU member state, you must also show:

- the letters ‘GB’ in front of your registration number for cross border supplies

- the registration number of the recipient of the supply preceded by the alphabetical code of the relevant EU member state

- a reference to any new means of transport

4.3 Example of a VAT invoice

A tax invoice

Sales invoice no 174

From: Foundation Trading (UK) Ltd VAT reg No 987 6543 21 Bowan Street, Chester

To: AN Other LTD57 North Road, London N12 5NA

Sale: Time of supply 30/10/07

Date of issue: 01/11/07

| Quantity | Description and price | Amount exclusive of VAT | VAT rate | VAT net |

|---|---|---|---|---|

| 6 | Radios, SW15 at £25.20 | £151.20 | 20 | £30.24 |

| 4 | DVD layers at £23.60 | £94.40 | 20 | £18.88 |

| — | — | £245.60 | — | £49.12 |

| — | VAT | £49.12 | — | — |

| — | Total | £294.72 | — | — |

4.4 VAT invoices issued by retailers

There’s no requirement to issue a VAT invoice for retail supplies to unregistered businesses. As a retailer, you may assume that no VAT invoice is required unless your customer asks for one. If you’re asked for an invoice then you have the following options.

If the charge you make for the individual supply is:

- £250 or less (including VAT), then you can issue an invoice showing your name, address and VAT registration number, the time of supply (tax point), a description which identifies the goods or services supplied, and for each VAT rate applicable, the total amount payable, including VAT shown in sterling and the VAT rate charged — exempt supplies must not be included in this type of VAT invoice

- more than £250 and you’re asked for a VAT invoice, then you must issue either a full VAT invoice or modified VAT invoice, showing VAT inclusive rather than VAT exclusive values

4.5 VAT simplified invoices issued by businesses other than retailers

If you’re not a retailer and the total value of your supply does not exceed £250 you may issue your customer with a simplified invoice. If you’re asked for an invoice then you have the following options.

If the charge you make for the individual supply is:

- £250 or less (including VAT), then you issue an invoice showing your name, address and VAT registration number the time of supply (tax point), a description which identifies the goods or services supplied, and for each VAT rate applicable, the total amount payable, including VAT shown in sterling and the VAT rate charged — exempt supplies must not be included in this type of VAT invoice

- more than £250, then you must issue either a full VAT invoice or a modified VAT invoice, showing VAT inclusive rather than VAT exclusive values

4.6 When to issue an invoice

You do not always have to issue a VAT invoice to a registered person if:

- your customer operates a self-billing arrangement or you issue authenticated receipts — see Self-billing (Notice 700/62) and Buildings and construction (VAT Notice 708) for more information

- you make a gift of goods on which VAT is due

- you sell goods under one of the VAT second-hand margin schemes — you can find out more about VAT Margin Schemes

- your invoice is only for exempt or zero-rated sales within the UK

4.7 Payment in cash when a VAT invoice has been issued

Your customer may need a receipt for the cash payment under the VAT rules that allow cash accounting rather than invoice accounting. If asked, you must give your customer a receipt for the amount and date it.

5. VAT account

5.1 Explanation of a VAT account

A VAT account is the link (the audit trail) between your business records and your VAT Return. Every VAT-registered business must keep a VAT account and it will help you to fill in your VAT Return. But there is no set format for a VAT account as long as it contains the information described in this section.

5.2 Keeping a VAT account

You can keep the VAT account in the way that suits your business, as long as it contains the information described in the following list. Most businesses are required to digitally keep an electronic account which includes all the information found in the VAT account.

To show the link between the output tax in your records and the output tax on the return, you must have a record of:

- the output tax you owe on sales

- the output tax you owe on acquisitions from EU member states if you are registered in Northern Ireland or on acquisitions made before 1 January 2020 if you are registered in Great Britain

- the tax you’re required to pay on behalf of your supplier under a reverse charge procedure

- tax that needs to be paid following a correction or error adjustment

- any other adjustment required by the VAT rules

To show the link between the input tax in your records and the input tax on your return you must have a record of:

- the input tax you’re entitled to claim from business purchases

- the input tax allowable on acquisitions from EU member states if you are registered in Northern Ireland or on acquisitions made before 1 January 2020 if you are registered in Great Britain

- tax that you’re entitled to following a correction or error adjustment

- any other necessary adjustment

5.3 Adjusting your VAT account

You may need to make an adjustment to your VAT account if you:

- allow or receive a credit which includes VAT

- make a retail scheme annual adjustment

- are using an approved estimation procedure

- have to make a partial exemption or capital goods scheme adjustment

- make a claim for bad debt relief

- correct a net error made on previous returns — see How to correct VAT errors and make adjustments or claims (VAT Notice 700/45)

6. Keeping digital and original records

All VAT registered businesses must keep and preserve certain records digitally and keep their accounts within functional compatible software.

Some software will record all your VAT records and accounts information. However, there are some records that by law must be kept and preserved in their original form, either for VAT purposes or other tax purposes. For example, you must still keep a C79 (import VAT certificate) in its original form.

Example 1

A business receives an invoice and enters selected data from the invoice into functional compatible software. They must still keep the invoice in its original form, because the data in the functional compatible software is not a copy of the invoice.

Example 2

A business has functional compatible software that scans the invoices received and puts the information in its ledger. If the image is retained and contains all the detail required for VAT purposes, the business does not need to keep the original invoice, unless it’s required for another purpose.

If you deregister from VAT, you no longer need to keep digital records in functional compatible software. However, you must still retain your VAT records for the required period.

7. Electronic account

The VAT account records must be kept, maintained and preserved digitally unless a customer has been provided an exemption. The exact way you must enter the information will depend on the software package you have. Contact your software provider if you’re unsure how to enter information into your software.

A business must have all records required for their electronic account to be in functional compatible software. A business can maintain their electronic account across more than one piece of software, as long as these products are digitally linked in accordance with the rules set out in paragraph 10.

7.1 Designatory data

You must have a digital record of:

- your business name

- the address of your principal place of business

- your VAT registration number

- any VAT accounting schemes that you use

7.2 Supplies made

For each supply you make, you must record the:

- time of supply — the tax point

- value of the supply — the net value excluding VAT

- rate of VAT charged

This only includes supplies recorded as part of your VAT Return. Supplies that do not go on the VAT Return do not need to be recorded in functional compatible software. For example, intra-group supplies for a VAT group are not covered by these rules.

The time of supply is the date you must declare output tax on. This is generally when you send a VAT invoice or, if you’re on cash accounting, when you receive payment for the supply. Find more information on time of supply in sections 14 and 15 of the VAT guide (VAT Notice 700).

Where more than one supply is recorded on an invoice and those supplies are within the same VAT period and are charged at the same rate of VAT, you can record them as a single entry.

Example 1

You sold 10 standard-rated items and 15 zero-rated items on a single invoice. You only need to record the total figures for each of the VAT rates.

Example 2

You’re on standard accounting and a customer makes a part payment before you send out an invoice. If the payment and invoice were received and sent in the same period, you can record the supply as one transaction, with one transaction date. Otherwise, where one supply needs to be recorded in different periods, the precise manner will depend on the software. This could be done by splitting the amounts out, or the software may allow one line to show different periods for the VAT to be recorded.

You must also have a record of output value for the period, split between supplies that are:

- standard-rate

- reduced-rate

- zero-rate

- exempt

- outside the scope of UK VAT — only those that you’re required to include in your VAT Return

Find more information on How to fill in and submit your VAT Return (VAT Notice 700/12) .

The following rule has the force of law:

Where you need to apportion the output tax due on a mixed-rate supply with a single inclusive price, you do not need to record these supplies separately. You can record the total value and the total output tax due.

Not all software will allow you to record a rate of VAT other than the standard, reduced, zero or exempt. If this is the case, this mixed supply should be recorded as either one standard-rated supply and one zero-rated supply, or you can record the sale at one rate and correct the VAT through an adjustment at the end of the period. You’ll also need to do this if you’re using a margin scheme or the Flat Rate Scheme.

Example 3

A business sells a meal deal for £3. It contains a zero-rated sandwich, a standard-rated pack of crisps and a standard-rated drink. The apportionment shows that the VAT due is 30p. The business can record this as an individual supply with 30p of output tax, if their software allows this. The following examples show how you can work this out:

Software allows input of total VAT

The value of the supply (net value excluding VAT): £2.70.

Total VAT charged: £0.30.

Meal deal recorded as standard rated and zero rated supplies

If their software does not allow the input of total VAT, you could record the supply as a standard-rated element of £1.50 and a zero-rated element of £1.20.

Element 1 (standard rated portion)

The value (net value excluding VAT): £1.50.

The rate of VAT charged: Standard rate.

Element 2 (zero rated portion)

The value (net value excluding VAT): £1.20.

The rate of VAT charged: Zero rate.

Supply recorded at one rate and VAT corrected at the end of the period

You could record the meal deal as one entry and correct the VAT at the end of the period.

The value of the supply (net value excluding VAT): £2.70.

The rate of VAT charged: Standard rate.

Adjustment to correct mixed rate VAT: -£0.24.

7.3 Supplies made by third party agents

A third party agent can act for, or represent, a business in arranging supplies of goods or services. The supplies that you arrange are made by, or to, the business represented.

HMRC is aware of a number of circumstances in which a third party agent makes supplies on behalf of a business and it may not be possible or practical for the business to record every single supply digitally. Therefore, we accept businesses recording these digitally as a single invoice.

The following rule has the force of law:

Where a third party agent makes supplies on your behalf, those supplies do not fall within the digital record keeping requirements until you receive the information from the agent. Where the information is received as a summary document, you can treat this document as one invoice issued by you for the purpose of creating your digital record.

This relaxation only varies the requirements on maintaining records using functional compatible software. It does not change any other record keeping requirements set out in VAT legislation.

Find more information on supplies made by or through agents in VAT guide (VAT Notice 700).

Example 1

A business uses a letting agent to rent out a number of properties. Each month the letting agent provides a summary of the rents collected and VAT charged. The business can treat all supplies covered in this summary document as if they were covered by a single sales invoice, rather than treating each invoice issued on their behalf separately. They can group transactions together, as long as they’re within the same VAT period and are charged at the same rate of VAT.

This rule would not cover circumstances where responsibility for supplies is assumed by other persons who are not third party agents of the business. For example, it does not cover supplies made by an employee on behalf of your business.

7.4 Supplies received

For each supply you receive you must record the:

- time of supply (tax point)

- value of the supply

- amount of input tax that you’ll claim

This only includes supplies recorded as part of your VAT Return, supplies that do not go on the VAT Return do not need to be recorded in functional compatible software. For example, wages paid to an employee would not be covered by these rules.

There is no requirement under the regulations to record inputs for the period split by VAT rate.

The time of supply is typically the date on the VAT invoice or, if you’re on cash accounting, when you pay for the supply. However, you must also hold the associated evidence to claim deduction of input tax. Find more information on timescales for claiming input tax in sections 14 and 15 of VAT guide (VAT Notice 700) .

If more than one supply is on an invoice, you can record the totals from the invoice. Where the amount of input tax you’ll claim is not known at the time you record the supply you’ve received, you can record:

- the total amount of VAT and adjust for any irrecoverable VAT once calculated

- no VAT and adjust for any recoverable VAT once calculated

- VAT recoverable based on an estimated percentage and adjust for any VAT once calculated

See paragraph 7.10 of this notice for information on adjustments.

Where an invoice includes supplies with different times of supply within the same VAT period, you may record all supplies on the invoice as being at the same date.

Example 1

A business uses cash accounting and has paid the amounts on the invoice over 3 months. Two of the months are in the same VAT period so can be recorded together. The payments relating to the other month must be recorded separately. The precise manner of recording the information in different periods will depend on the software. This could be done by splitting the amounts out, or the software may allow one line to show different periods for the VAT to be recorded.

If a business pays the actual cost (or a proportion) of the travel and subsistence costs of an employee or, in the case of a charity, an unpaid volunteer, it can claim the total (or a proportion) of the total input tax incurred.

The following rule has the force of law:

Where you’re claiming input tax on an employee’s or volunteer’s expenses, and that individual provides the combined value of more than one purchase, you do not have to record each purchase separately. You can record the total value and the total input tax allowable.

Find more information on subsistence and the effect on input tax claims in VAT guide (VAT Notice 700).

7.5 Use of supplier statements

Some businesses record the value of each supply from a supplier statement, instead of doing individual invoices. This generally occurs when a business receives a large number of invoices from the same source.

HMRC encourages businesses to record the individual supplies digitally, because it lowers the risk of invoices being missed or entered twice (once as an invoice and once as part of the statement). There’s also less risk of the wrong rate of VAT being applied.

HMRC accepts there may be additional work for a business when capturing individual supplies digitally, and that this could also lead to data entry errors. Therefore, HMRC accept the recording of totals from a supplier statement, where all supplies on the statement relate to the same VAT period and the total VAT charged at each rate is shown. If you choose to do this, you must also cross reference all supplies on the supplier statement to invoices received — this can be done outside of your digital records.

The following rule has the force of law:

Where a supplier issues a statement for a period, you may record the totals from the supplier statement (rather than the individual invoices), as long as all supplies on the statement are included on the same return and the total VAT charged at each rate is shown.

7.6 Petty cash transactions

Petty cash is traditionally a small amount of cash on hand that covers day-to-day expenses of a business, such as buying a pint of milk. In some businesses, it can be used to describe costs that are not attributable to an individual account in their records. Requiring businesses to record each of these transactions in digital records could be an unreasonable administrative burden for businesses. Therefore, HMRC accept that a number of petty cash transactions can be recorded as a single purchase in the digital records of the business, subject to a monetary limit.

The following rule has the force of law:

Where a business uses petty cash to pay for small value items, these do not need to be individually recorded in the digital records. The business can record the total value and the total input tax allowable. This applies to individual purchases with a VAT-inclusive value below £50. The total value of petty cash transactions recorded in this way cannot exceed a VAT-inclusive value of £500 per entry.

7.7 Supplies received by third party agents

A third party agent can act for, or represent, a business in arranging supplies of goods or services. The supplies that you arrange are made by, or to, the business represented.

A third party agent may make purchases on behalf of a business and it may not be possible or practical for them to digitally record every single supply received. Therefore, HMRC accepts businesses digitally recording these as a single invoice.

The following rule has the force of law:

Where a third party agent makes purchases on your behalf, those purchases do not fall within the digital record keeping requirements until you receive the information from the agent. Where the information is received as a summary document, you can treat this document as one invoice received by you for the purpose of creating your digital record.

This only relaxes the requirements on maintaining records using functional compatible software. It does not change any other record keeping requirements set out in VAT legislation.

Find more information about supplies made by or through agents in VAT guide (VAT Notice 700).

7.8 Charity fundraising events

A charity fundraising event can include a number of supplies that would need to be recorded on a VAT return. Charities may find it difficult to meet the strict digital record keeping requirements for events run by volunteers. Therefore, HMRC accepts that charities can digitally record all supplies made (relating to the event) as if it were a single invoice, and all supplies received can be treated the same.

The following rule has the force of law:

Where supplies are made or received during a charity fundraising event run by volunteers, you may treat all supplies made as covered by one invoice for the event, and all supplies received as covered by one invoice for the event, for the purposes of the digital record keeping requirements.

This only relaxes the requirements on maintaining records using functional compatible software. It does not change any other record keeping requirements set out in VAT legislation.

Example 1

A church fete is being run for a charity. During the event, volunteers create a record of the supplies made. When the event is over, the charity can record the total supplies made at the same rate of VAT, and with the same tax point as a single entry in their functional compatible software. They can also record all supplies received as a single entry in functional compatible software.

7.9 Summary data

To support each VAT Return you make, your functional compatible software must contain:

- the total output tax you owe on sales

- the total tax you owe on acquisitions from EU member states

- the total tax you’re required to pay on behalf of your supplier under a reverse charge procedure

- the total input tax you’re entitled to claim on business purchases

- the total input tax allowable on acquisitions from EU member states

- the total tax that needs to be paid or you’re entitled to reclaim following a correction or error adjustment

- any other adjustment allowed or required by VAT rules

A total of each type of adjustment must be recorded as a separate line.

7.10 Adjustments

Where you’re allowed or required to adjust the input tax claimed or output tax you owe (according to the VAT rules), you must record this adjustment in functional compatible software. Only the total for each type of adjustment will be required to be kept in functional compatible software, not details of the calculations underlying them.

If the adjustment requires a calculation, this calculation does not need to be made in functional compatible software. If the calculation is completed outside of functional compatible software, digital links are not required for any information used in the calculation. However, using software for all your calculations will reduce the risk of errors in your returns.

The following rule has the force of law:

Where the input tax claimed or output tax due on a supply has been changed as the result of an adjustment, you do not need to amend the digital record of the supply.

Example 1

A partly exempt business software allows it to record amounts of VAT relating to both exempt and taxable supplies. At the end of the period, they complete a partial exemption calculation and put the adjustment into their return. The calculation is not completed in the software. The business does not have to go back and change each line in the software to reflect the amount of recovery on each invoice.

Example 2

A business has a software package that requires a period to be closed before the return can be completed. After the period has been closed, the business calculates adjustments before submitting the return. Invoices are found that should be included on the return. The business can enter the figures as an adjustment to make sure the return is correct, but they must record the invoices in their functional compatible software to complete their digital records.

This only relaxes the requirements on maintaining records using functional compatible software. It does not change any other record keeping requirements set out in VAT legislation.

7.11 Correcting errors

Error corrections are made by one of 2 methods.

Find out more information on correcting errors in How to correct VAT errors and make adjustments or claims (VAT Notice 700/45).

The following rule has the force of law:

Where a business makes an error correction using method 2, they’re not required to amend the input tax claimed or output tax charged recorded in the digital record of the supply.

Example 1

A business notices an error in its records. The total value of the error is £65,000, so the business must correct it using error correction method 2 (as detailed in paragraph 4.4 in How to correct VAT errors and make adjustments or claims (VAT Notice 700/45)). The business does not have to make any changes in its functional compatible software, but must keep all records as normal.

This only relaxes the requirements on maintaining records using functional compatible software. It does not change any other record keeping requirements set out in VAT legislation.

7.12 Retail schemes

The following rule has the force of law:

In addition to the records listed in paragraph 7.1, if you account for VAT using a retail scheme, you must keep a digital record of your daily gross takings (DGT). You’re not required to keep a separate record of the supplies that make up your DGT within functional compatible software.

Find more information on retail schemes and DGT in Retail schemes (VAT Notice 727).

7.13 Flat rate Scheme

The following rule has the force of law:

If you account for VAT using the Flat Rate Scheme, you do not need to keep a digital record of:

- your purchases unless they’re capital expenditure goods on which input tax can be claimed

- the relevant goods used to determine if you need to apply the limited cost business rate

If your software does not include a Flat Rate Scheme setting, and does not allow you to include a rate of VAT other than standard, reduced, zero or exempt, then you’ll need to record the supply as either one standard-rated supply and one zero-rated supply.

Alternatively, you can record the sale at one rate and correct the VAT through an adjustment at the end of the period. HMRC also allows you to use this method to correct the VAT on a mixed supply.

Find more information on the Flat Rate Scheme for small businesses (VAT Notice 733).

7.14 Gold Special Accounting Scheme

The following rule has the force of law:

In addition to the records listed in paragraph 7.1, if you make any sales under the Gold Special Accounting Scheme, you must keep a digital record of the following:

- value of sales made under the special accounting scheme for gold

- total output tax on purchases under the special accounting scheme for gold

7.15 Margin schemes

You do not need to keep digital records of the:

- additional records for these schemes

- calculation of the marginal VAT charged

These records must still be maintained in some format, but do not need to be in a digital format.

If you do keep a digital record, and your software does not allow you to record the VAT on the margin, you’ll need to record the supply as either one standard-rated supply and one zero-rated supply. Alternatively, you can record the sale at one rate and correct the VAT through an adjustment at the end of the period. HMRC will also allow you to use the same method to correct the VAT on a mixed supply.

Find more information on VAT Margin Schemes.

8. Digital record-keeping

All VAT registered businesses must keep and preserve certain records and accounts within functional compatible software.

Some software will record all your VAT records and accounts information. However, there are some records that by law must be kept and preserved in their original form, either for VAT purposes or other tax purposes. For example, you must still keep a C79 (import VAT certificate) in its original form.

Example 1

A business receives an invoice and types selected data from the invoice into functional compatible software. They must still keep the invoice in its original form, because the data in the functional compatible software is not a copy of the invoice.

Example 2

A business has functional compatible software that scans the invoices received and puts the information in its ledger. If the image is retained and contains all the detail required for VAT purposes, the business does not need to keep the original invoice, unless it’s required for another purpose.

If you deregister from VAT, you no longer need to keep digital records in functional compatible software. However, you must still retain your VAT records for the required period.

9. Functional compatible software

Functional compatible software is:

- a software program or set of software programs

- a product or set of products

- an application or set of applications

It must be able to:

- record and preserve digital records

- provide HMRC information and returns from data held in those digital records, using the API platform

- receive information from HMRC, using the API platform

If software you use has all of these functions, the digital links rules in paragraph 10 may not be relevant to you.

Some software programs will not be able to perform all of these functions by themselves. For example, a spreadsheet (or other software product capable of recording and preserving digital records) may not be able to perform the other functions such as sending and receiving data through an API platform. However, this can still be a component of functional compatible software if it’s used together with one or more programs that perform the other functions.

The complete set of digital records does not have to be held in one place or in one program. Digital records can be kept in a range of compatible digital formats. Taken together, these form the digital records for the VAT registered entity.

Functional compatible software recognised by HMRC can be found in compatible software for Making Tax Digital for VAT.

10. Digital links

Data transfer or exchange within and between software programs, applications or products (that make up functional compatible software) must be digital where the information continues to form part of your electronic account.

Once data has been entered into software that you use to keep and maintain your electronic account, any further transfer, recapture or modification of that data must be done using digital links. Each piece of software must be digitally linked to other pieces of software, to create the digital journey.

Manually transferring data within or between software programs, products or applications (that make up functional compatible software) is not acceptable. For example, you must not note down details from an invoice in a ledger, then use that handwritten information to manually update another part of the business functional compatible software system.

A digital link is where a transfer or exchange of data is made (or can be made) electronically between software programs, products or applications. A digital link does not need any manual intervention, such as the copying over of information by hand, or the manual relocation of data between 2 or more pieces of software. This could be a transfer or exchange of data within a business (for example, between 2 systems), or a transfer of data to a tax agent.

A digital link includes linked cells in spreadsheets. For example, if you have a formula in one sheet that mirrors the source’s value in another cell, then the cells are linked.

HMRC also accepts the following as digital links:

- emailing a spreadsheet containing digital records, so the information can be imported into another software product

- transferring a set of digital records onto a portable device (for example, a pen drive, memory stick or flash drive) and physically giving this to someone else, who then imports the data into their software

- XML, CSV import and export, and download and upload of files

- automated data transfer

- API transfer

This list is not exhaustive.

HMRC does not consider the use of ‘cut and paste’ or ‘copy and paste’ to select and move information, as a digital link.

VAT information may be captured and retained in other software (for example, sales invoicing software or general ledger systems). However, if this software is not used to maintain your electronic account, there is no requirement for a digital link to be used when data is transferred to the electronic account.

The following rule has the force of law:

A digital link is an electronic or digital transfer, or exchange of data, between software programs, products or applications. The use of ‘cut and paste’ or ‘copy and paste’ does not constitute a digital link. If a set of software programs, products or applications are used as functional compatible software there must be a digital link between these pieces of software.

11. VAT calculations made outside of software

When you prepare your VAT Return, you may need to make calculations outside of the software you use to keep the digital records. There may also be a need to enter data into your software from particular sources. For example, a capital goods scheme adjustment calculation done in a spreadsheet may need some form of manual input to send your VAT Return information to HMRC.

12. API-enabled spreadsheets

These are spreadsheets that incorporate the relevant APIs. They can either:

- combine with accounting software to digitally submit the required information to HMRC and allow HMRC to communicate digitally with the business

- be used to keep digital records and then directly submit the required VAT information digitally to HMRC

13. Agents

You may authorise HMRC to receive data from (and send data to) an agent on your behalf. Once you’ve done this, that agent can use software to create, view, edit and send your data to HMRC. Your agent may also keep and maintain digital records on your behalf.

You’ll be able to have more than one agent performing different services for you, and you’ll be able to manage different levels of permission for each of them.

Agents must have software of their own, or have access to the software that holds their client’s digital records.

Agents will not necessarily have access to all of their client’s source data. For example, they may not always be able to make corrections to their client’s digital records. In these circumstances, the agent will need to advise their client of any corrections required to those digital records.

HMRC will only provide access to taxpayer information we hold, and the necessary services, to those agents who have been properly authorised.

14. Examples of where a digital link is required

These examples:

- show the extent to which digital links are required between software programs used by a business or its agent

- account for the variety of digital record-keeping and reporting options businesses have

- are not intended to be exhaustive or prescriptive

There are various methods of inputting data and transferring data across functional compatible software.

These methods are:

- mandatory digital links — only a digital link can be used for inputting and transferring the data

- non-mandatory digital links — the digital link is not necessary, but is used to reduce the risk of errors and support productivity

- manual input — the information can be input manually but a digital link could still help reduce errors and support productivity

The method used depends on each situation.

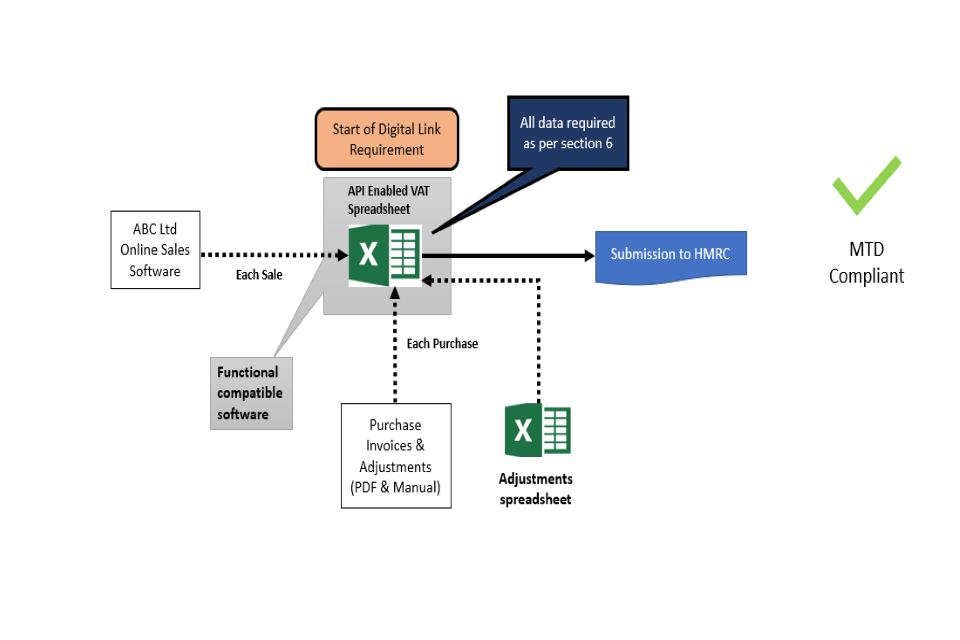

Example 1

A business uses a single piece of functional compatible software, an API enabled VAT spreadsheet.

The business sells widgets online to customers in the UK and abroad. It has specialist online sales software that records each sale as it occurs. This software does not have an export function, meaning it cannot digitally link to another piece of software or application. Therefore, each sale is entered into the API enabled spreadsheet using manual input.

Purchase invoices are kept in a range of formats, some are in an online or PDF format, others are on paper (hardcopies). Each of the invoice values are entered into the API enabled VAT spreadsheet by manual input, to calculate the total deductible input tax.

Adjustments for road fuel scale charge and non-business-use purchases are calculated, and the total amount of each adjustment is entered in the API enabled spreadsheet by manual input. A separate spreadsheet is used to calculate a partial exemption adjustment, and the total amount of this adjustment is also entered in the API enabled VAT spreadsheet by manual input. Each adjustment is entered as a separate line, with a descriptor explaining the type of entry or adjustment made.

Once the required data is entered into the API enabled spreadsheet, it calculates the VAT Return and transfers the data to HMRC, using a mandatory digital link. The digital link requirement starts from the API enabled spreadsheet because this is the point where the electronic account information is being stored.

This is a compliant journey because the API enabled spreadsheet:

- provides HMRC information and VAT Returns using the API platform, from data held in digital records

- allows the business to receive information from HMRC using the API platform

- retains the required designatory data in line with paragraph 7.1

- captures sales invoice data for each supply made (which is entered manually), in line with paragraph 7.2

- captures purchase invoice data for each supply received (which is entered manually), in line with paragraph 7.4

Therefore, it meets all of the conditions to maintain an electronic account within functional compatible software.

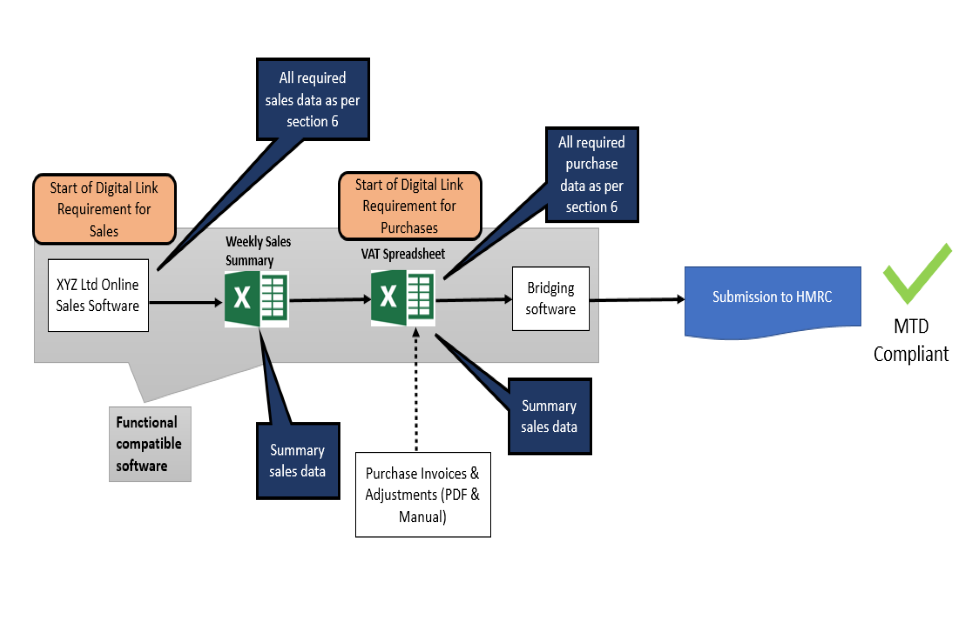

Example 2

A business uses 4 pieces of functional compatible software, including:

- online sales software

- a spreadsheet that captures a summary of sales made

- a VAT spreadsheet that compiles figures for the VAT Returns

- bridging software

The business sells widgets online to customers in the UK and abroad. It has specialist online sales software that records each sale as it occurs. The online software’s reporting function only produces weekly and monthly summaries of sales totals, including the net VAT gross total values.

Rather than manually entering the sales into their VAT spreadsheet, the business downloads a weekly spreadsheet report from the online sales software, and uses a formula to digitally link the spreadsheets together to compile output tax for the VAT return.

Purchase invoices are kept in a range of formats, some are in an online or PDF format, others are on paper (hardcopies). Each of the invoice values are entered into the VAT spreadsheet by manual input, to calculate the total deductible input tax.

Adjustments for road fuel scale charge and non-business-use purchases are calculated, and the total amount of each adjustment is entered in the VAT spreadsheet by manual input. Each adjustment is entered as a separate line, with a descriptor explaining the type of entry or adjustment made.

Once all of the data required is entered into the VAT spreadsheet, it calculates the VAT Return and transfers it through a mandatory digital link to bridging software. The bridging software then submits the VAT return to HMRC through an API. As an alternative to bridging software, the spreadsheet could have API functionality built into it.

The digital link requirement for sales data starts at the online sales software because this is the only place where data is held in line with paragraph 7.2, and it forms the start of the electronic account and functional compatible software.

The digital link requirement for purchase data starts in the VAT spreadsheet because this meets the requirements set out in paragraph 7.4.

This is a compliant journey because:

- the VAT spreadsheet provides HMRC with information and VAT Returns using a bridging software, from data held in digital records, using the API platform

- the bridging software allows the business to receive information from HMRC using the API platform

- purchase invoice data for each supply received is entered manually, in line with paragraph 7.4

- the VAT spreadsheet retains the required designatory data in line with paragraph 7.1

- although only summaries of weekly VAT data is entered into the VAT spreadsheet, there are digital links between the weekly sales summaries and the online sales software, where the invoice level data is captured digitally — this meets the requirements set out in paragraph 7.2

Taken together and digitally linked, all the pieces of software maintain the electronic account within a set of functional compatible software.

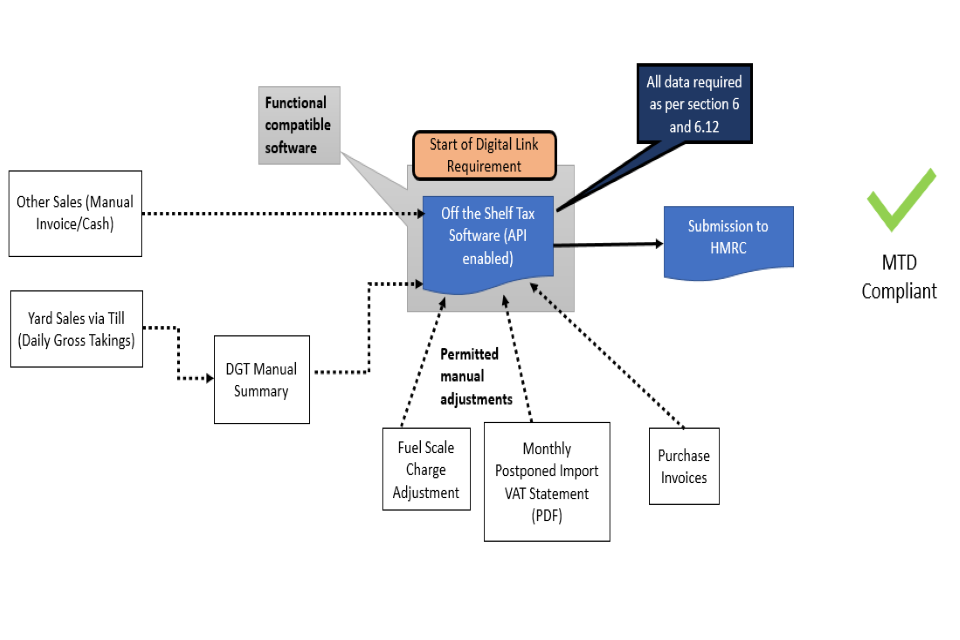

Example 3

A builder’s yard business uses a delivery driver to make ad hoc sales from a van, during deliveries to customers.

The business has a non-digital till in the yard shop and carbon-copy invoice book for the driver to use when making sales to customers. The daily gross takings (DGT) are taken from the till at the end of the working day (known as a Z read) and are recorded manually on a daily takings sheet.

The Z read shows the sales totals and a summary of relevant till actions for a trading day. This is sometimes known as the end of day report. At the end of the week, the daily taking sheets, supporting Z readings and carbon copy driver’s sales book are given to the book keeper, who manually enters the DGT and driver’s sales into an ‘off the shelf’ API enabled software package.

In addition to these sales, the business purchases stock domestically and from abroad. The book keeper manually enters the purchase invoice values and dates directly into the API enabled software package. They also enter the appropriate VAT values from the Monthly Postponed Import VAT statement (MPIV) PDF provided by HMRC.

The Director and Company Secretary claim back the fuel on their company cars, so the book keeper manually enters in the adjustment values for the Road Fuel Scale Charge directly into the API enabled software package.

The digital link requirement starts from the API enabled software package because this is the point where the electronic VAT Account information is being stored.

This is a compliant journey because the API enabled software product:

- provides HMRC information and VAT Returns using the API platform, from data held in digital records

- allows the business to receive information from HMRC using the API platform

- retains the required designatory data in line with paragraph 7.1

- captures purchase invoice data for each supply received, in line with paragraph 7.4

- digitally captures DGT data, in line with paragraph 7.12

- captures data from carbon copy sales for each supply made, in line with paragraph 7.2

- captures MPIVs and road fuel scale charge adjustments (which is entered manually), in line with paragraph 7.10

Therefore, it meets all of the conditions to maintain an electronic account within functional compatible software.

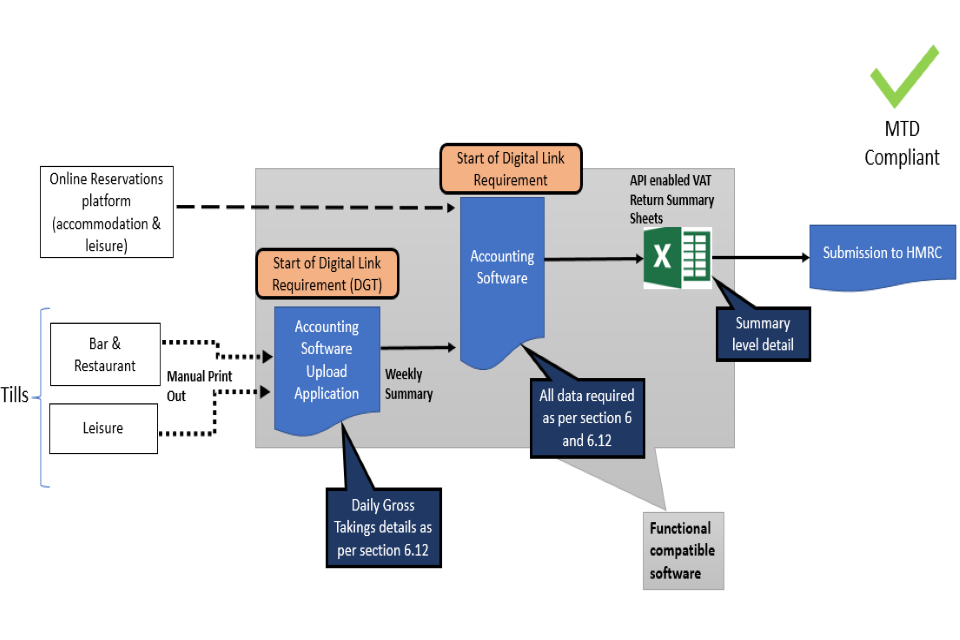

Example 4

A mid-size corporate holiday provider has an on-site bar, restaurant and walk-in leisure facilities in 3 locations.

The business uses a website (platform) to allow its customers to book accommodation and leisure facilities. The website sends the sales invoice information by a non-mandatory digital link, directly into the accounting software.

Individual daily sales reports are created from individual tills, detailing the daily gross takings (DGT). This information is printed, scanned and emailed to the head office from each site and manually entered into an accounting software upload application. A weekly summary is then digitally uploaded into the accounting software for retail sales, using a mandatory digital link.

The accounting software upload application stores the DGT data as detailed in paragraph 7.12. This is the start of the digital link requirement for retail sales because the product is keeping and preserving the DGT data in a digital format. There is no requirement to digitally retain data for each retail sale, as the record required is the DGT. The underpinning VAT records (for example, till rolls or Z readings) will need to be retained, but do not need to be kept digitally.

The accounting software is not tax specific, but it does collate all sales and purchase information, and provides summary totals for input and output tax to an API enabled VAT Return summary spreadsheet, using a mandatory digital link. The API enabled spreadsheet is used to calculate the VAT summary and submit a VAT Return to HMRC.

The digital link requirement for online sales starts from the accounting software, and starts for the DGT at the accounting software upload application.

This is a compliant journey because:

- the upload application digitally captures DGT data, in line with paragraph 7.12

- the API enabled VAT spreadsheet provides HMRC information and VAT Returns using the API platform, from data held in digital records

- the API VAT spreadsheet allows the business to receive information from HMRC using the API platform

- the API enabled VAT spreadsheet retains the required designatory data in line with paragraph 7.1

- although only a combined weekly DGT summary data of all tills is passed over to the accounting software, there are digital links between the weekly sales summary and the DGT stored in the upload application

Taken together and digitally linked, the software products maintain the electronic account within a set of functional compatible software.

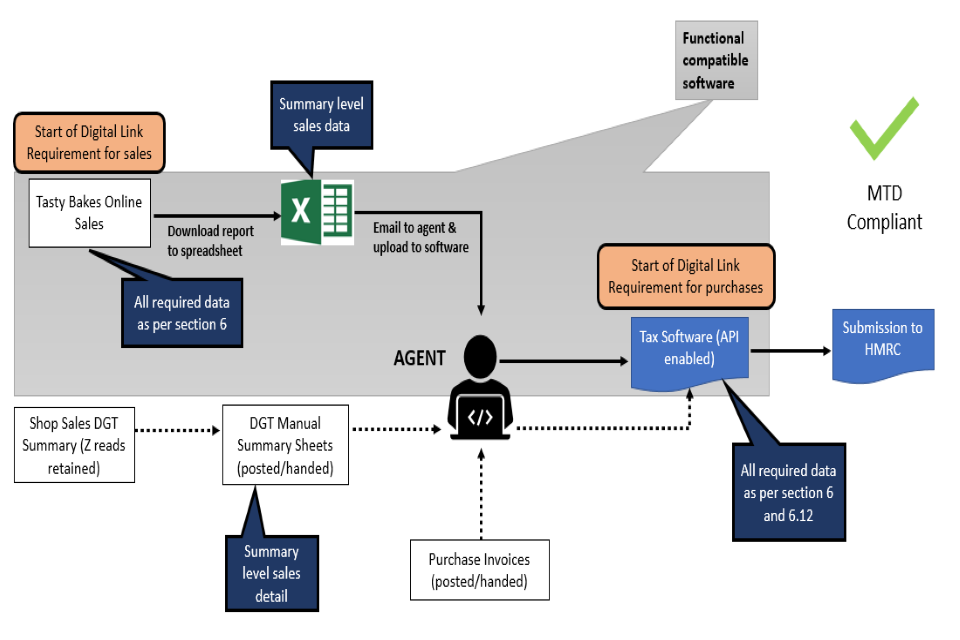

Example 5

A sole proprietor bakery operates from a single high street premises with one till. They offer an online ‘click and collect’ service.

Invoices are automatically emailed to customers in PDF format once an order is completed, and an online sales software retains a record of them. An online sales report with summary level data from these invoices is downloaded to a spreadsheet and emailed to the agent, using mandatory links. The agent manually uploads the online sales summary values from the spreadsheet into API enabled software.

Till Z readings are recorded manually in a DGT manual and this is posted (or given in person) to the agent, along with paper purchase invoices and the original till Z readings. The agent manually enters the DGT amounts and purchase invoice details into the API enabled software.

The API enabled software then creates the VAT Return and emails it to HMRC.

The digital link requirement starts from the online sales software for supplies ordered online because this is the point where the electronic account information is retained and preserved.

This is a compliant journey because the online sales software and API enabled software:

- provides HMRC information and VAT Returns using the API platform, from data held in digital records

- allows the business to receive information from HMRC using the API platform

- retains the required designatory data in line with paragraph 7.1

- captures individual invoice level data for each online ‘click and collect’ sale made, in line with paragraph 7.2

- digitally captures DGT data, in line with paragraph 7.12

- captures purchase invoice data for each supply received (which is entered manually), in line with paragraph 7.4

Taken together and digitally linked, the software maintains the electronic account within a set of functional compatible software.

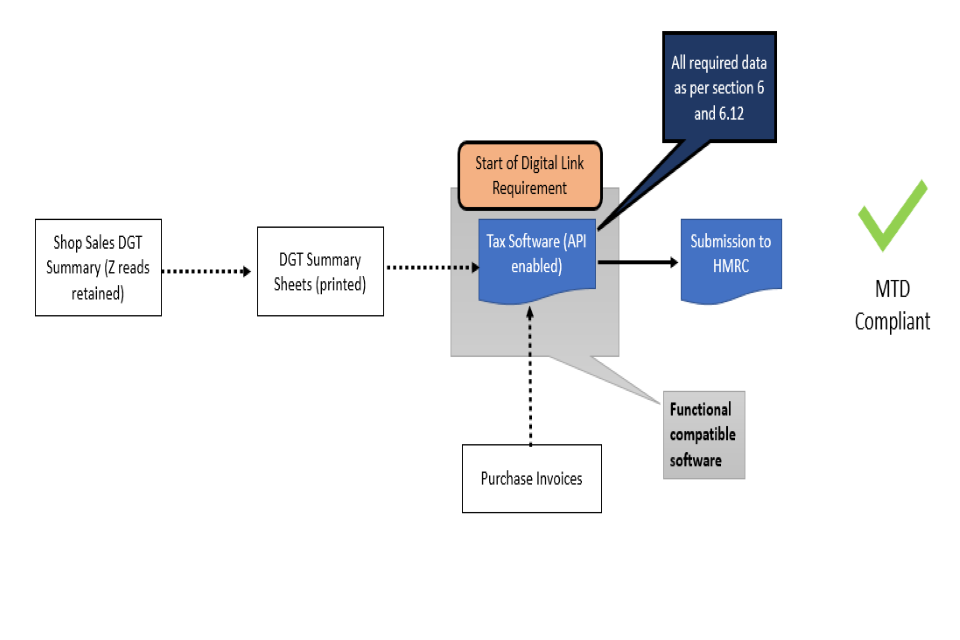

Example 6

A business sells food, drink and other products at various rates of VAT.

The business uses an electronic till that can scan products and identify the appropriate rate of VAT. They operate the point of sale retail scheme and the till’s DGT. A Z reading provides a breakdown of the total amount of goods sold at each rate of VAT.

The till is not capable of digitally exporting DGT data to the business’s API enabled tax software package. Instead, the daily summary sheet from the till is printed off and the summary totals for the different rates of VAT are manually entered, using the appropriate tax code. The electronic till complies with all other VAT record keeping requirements of the point of sale retail scheme.

Purchase invoice details are manually entered into the API enabled Tax Software.

The API enabled software then creates the VAT Return and emails it to HMRC.

This is a compliant journey because the API enabled tax software:

- provides HMRC information and VAT Returns using the API platform, from data held in digital records

- allows the business to receive information from HMRC using the API platform

- retains the required designatory data in line with paragraph 7.1

- captures purchase invoice data for each supply received (which is entered manually), in line with paragraph 7.4

- digitally captures DGT data, in line with paragraph 7.12

Therefore, it meets all of the conditions to maintain an electronic account within functional compatible software.

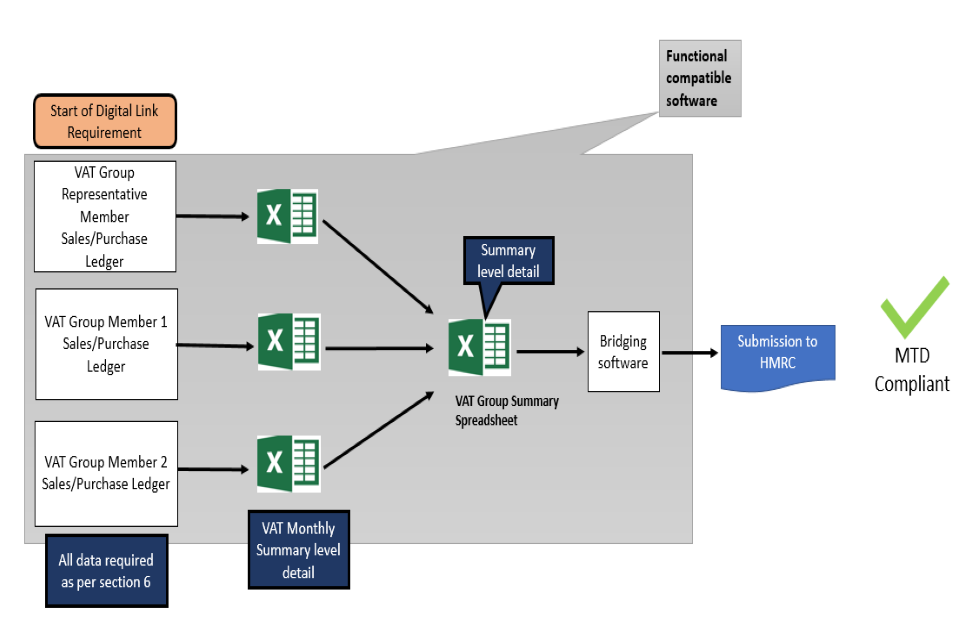

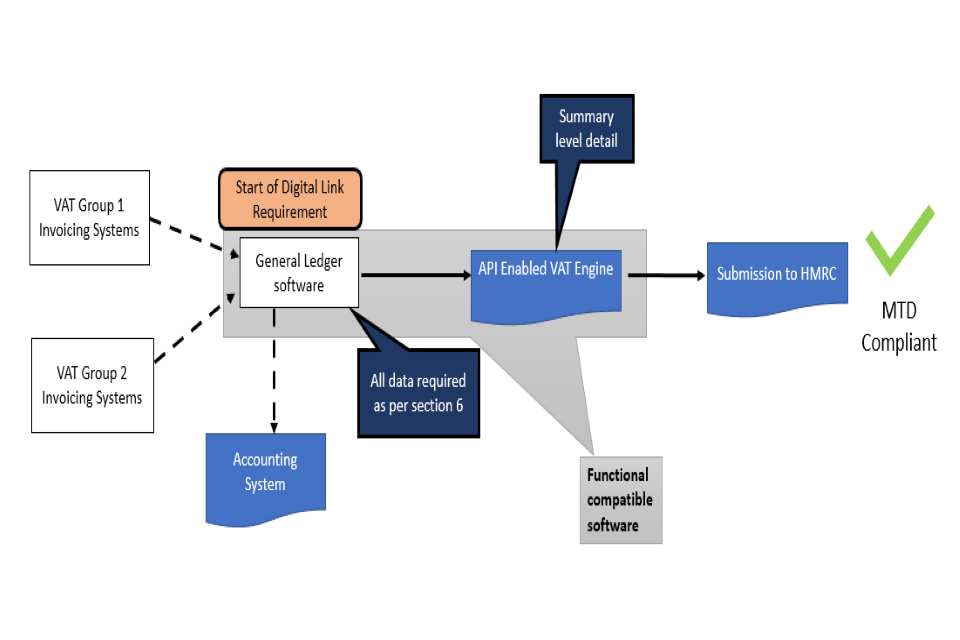

Example 7

A VAT group contains 3 different businesses making supplies of goods and services, connected to commercial property management.

Each business within the VAT group uses a different type of sales or purchase ledger software to digitally record sales and purchases. Each of the business’s software is able to digitally export their monthly summary figures to a spreadsheet that is provided to the Head Office (or VAT group representative member), using a mandatory digital link.

The Head Office (or VAT group representative member) then digitally transfers the monthly summary figures from each of the spreadsheets into a separate master summary spreadsheet. This produces the combined single VAT return for the group. The master summary spreadsheet is not API enabled, so the business uses a mandatory link to transfer the data to a bridging software, which then sends the VAT Return to HMRC.

The digital link requirement starts from the individual VAT group members’ sales or purchase ledger software.

This is a compliant journey because:

- the API bridging software provides HMRC information and VAT Returns using the API platform, from data held in digital records

- the API bridging software allows the business to receive information from HMRC using the API platform

- the VAT summary spreadsheet retains the required designatory data in line with paragraph 7.1

- there are digital links in place from each of the business’s sales or purchase ledger software to the API submission of the VAT Return to HMRC

- sales invoice data for each supply made is captured in line with paragraph 7.2

- purchase invoice data for each supply received is captured in line with paragraph 7.4

Taken together and digitally linked, all the pieces of software maintain the electronic account within a set of functional compatible software.

Example 8

A large investment bank has multiple service lines and two different invoicing systems. Both systems are drawn up into a bespoke piece of VAT engine software developed in-house by the bank.

The VAT engine automates the capture of accounts payable invoice data, general ledger and reference data (global and product specific) from several systems by:

- allocating input tax according to agreed sectorized method (for partial exemption purposes)

- calculating how much input tax can be recovered by entities within the individual VAT registrations

- capturing the amount of output tax charged to clients at entity level

- compiling all figures in a structured way and generates standardized reports to support VAT return filing

- enabling VAT return filing via API to HMRC

The VAT engine receives transactional level data for purchases from the general ledger for partial exemption calculation purposes, but only summary totals are received for sales.

The invoicing systems use non-mandatory links to transfer data to a general ledger software. The general ledger software uses a mandatory link to transfer data to the API enables VAT engine.

The digital link requirement starts at different places because the data that is retained and transferred between software products. For sales, the requirement starts at the general ledger system (where the data is held in line with paragraph 7. For purchases, the digital link requirement starts from the API enabled VAT engine, as the full transactional data for purchases is also retained in line with paragraph 7.

This is a compliant journey because the:

- API enabled VAT engine provides HMRC information and VAT Returns using the API platform, from data held in digital records

- API enabled VAT engine allows the business to receive information from HMRC using the API platform

- general ledger software retains all of the required data, in line with paragraph 7

- digital link requirement only starts at the general ledger system for sales and the API enabled VAT engine for purchases — there are digital links between software products to maintain the electronic VAT account

Taken together and digitally linked, the pieces of software maintain the electronic account within a set of functional compatible software.

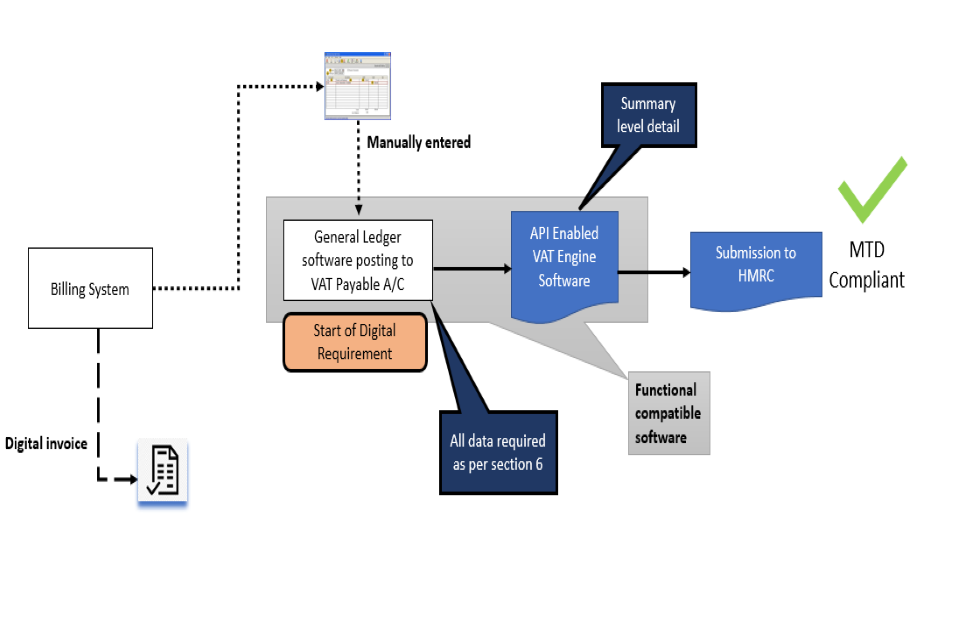

Example 9

A small standalone entity within a corporate bank structure has a billing system that is not compatible with the general ledger software. Because of this, manual entry from an extracted journal report is posted to the general ledger.

The general ledger software uses a mandatory link to transfer the data to an API enabled VAT engine software, which complies the VAT Reports and transfers it to HMRC. The digital link requirement starts from the general ledger because this holds all the detailed information on the sales made and therefore, is the point where the electronic account information is stored.

The billing system is not being used to maintain the electronic account, which places it outside of the functional compatible software requirement. Therefore, manual entry of data from the billing system into the general ledger software is permissible.

The end-to-end journey is partially digital, as the business cannot justify the expense of full digitisation from the billing system due to the small number of invoices processed (although full digitisation of the journey is recommended).

This is a compliant journey because the:

- API enabled VAT engine provides HMRC information and VAT Returns using the API platform, from data held in digital records

- API enabled VAT engine allows the business to receive information from HMRC using the API platform

- general ledger software and API enabled VAT engine retains all of the required data, in line with paragraph 7

- digital link requirement only starts at the general ledger software, as the billing system is not being used to maintain the electronic account

Taken together and digitally linked, the pieces of software maintain the electronic account within a set of functional compatible software.

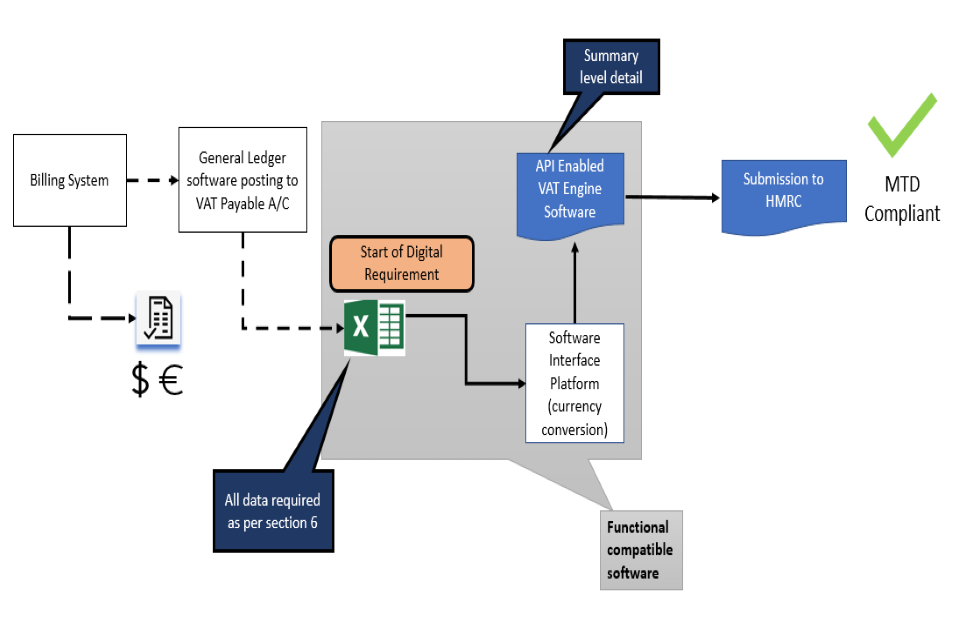

Example 10

The UK entity of an investment bank (within the corporate group), digitally invoices clients based abroad in US Dollars and Euros.

There is a non-mandatory digital link between the billing system and general ledger software. Because the VAT engine cannot convert foreign currency into Sterling, data is exported from general ledger software to a spreadsheet (using a non-mandatory digital link), and then the daily sales totals are transferred form the spreadsheet to a Software Interface Platform for currency conversion (using a mandatory digital link). From there, summary totals are transferred to the API enabled VAT engine to produce the VAT Return and submit to HMRC.

The digital link requirement starts from the spreadsheet because this holds the same level of data as the general ledger (data required under paragraph 7, and is the point where the electronic account information is being stored. However, if the spreadsheet held only summary level data, then a mandatory digital link would be required from the general ledger to the spreadsheet, in order to comply with rules set out in paragraph 7 .

This is a compliant journey because:

- API enabled VAT engine provides HMRC information and VAT Returns using the API platform, from data held in digital records

- API enabled VAT engine allows the business to receive information from HMRC using the API platform

- the spreadsheet, Software Interface Platform and API enabled VAT engine retain all of the required data in line with paragraph 7

- digital link requirements only start at the spreadsheet because the general ledger software is not being used to maintain the electronic account — however, in this example, there is a digital link in place between the general ledger software and the spreadsheet, as it’s more efficient for the business and reduces the chance of error

Taken together and digitally linked, the pieces of software maintain the electronic account within a set of functional compatible software.

15. Exemptions from keeping an electronic account

Who is exempt

You do not need to keep an electronic account if HMRC is satisfied that:

- it’s not practical for you to use digital tools to keep your business records or submit your VAT Returns — this may be due to reasons such as age, disability or location

- you (or your business) are subject to an insolvency procedure

- your business is run entirely by practising members of a religious society (or order) whose beliefs are incompatible with using electronic communications or keeping electronic records

- you’re already exempt from filing VAT returns online

Examples of businesses who are exempt

You’ll be exempt if it’s not practical for you to keep records digitally due to:

- your location — for example, if you cannot get internet access at your home or business premises, and it’s not reasonable for you to get internet access at another location

- a disability — for example, if you cannot use a computer, tablet or smartphone for the frequency or amount of time it takes to keep digital records for your business

You might not be exempt if you:

- believe you should be exempt purely because of your age — HMRC will consider how your age and circumstances impact your ability to keep an electronic account

- believe you should be exempt because you’re unfamiliar with the relevant software — HMRC will take into account how much you use (or intend to use) digital devices for other purposes, and if it’s reasonable for you to learn how to use functional compatible software

- consider yourself to be a practising member of a religious society or order whose beliefs are incompatible with the use of electronic communications, but you already file online and use a computer or smart device for other business or personal uses

If you get help from a third party

If you get help from a third party to meet your obligations (for example, a bookkeeper, agent, friend or family member), they’ll need either:

- full access to your digital business records — so you’ll need to be content that your information is secure

- you to keep digital business records and then electronically extract the data and send it to them by electronic means — for example, by using a pen drive or emailing a file

If the third party stops supporting you and you do not think you can keep an electronic account without their support, you should ask HMRC for an exemption.

Ask HMRC for an exemption

To make a claim for exemption, contact VAT: general enquiries.

You’ll need:

- your VAT Registration Number

- your business name and principal place of business

- the reason for your exemption request

- details about how you currently file your VAT Returns

- the reasons why you would not be able to file returns through software or keep digital records (even if you can file using VAT online services)

- any other reason why you cannot follow the requirements

You can ask an agent, friend or family member to ask for an exemption on your behalf, but they must:

- fully understand your circumstances in relation to getting an exemption

- have authority to act on your business’ behalf — such as written authorisation sent to HMRC or verbal authorisation by telephone

It’s usually better to call HMRC yourself where possible, because you have a better understanding of your abilities and how you engage with technology in your personal life. The helpline advisers will talk to you about the support you can get from HMRC.

Whilst HMRC intends to deal with as many telephone requests as possible, we may ask you to make a request in writing.

HMRC will make a decision after you’ve provided all the necessary information. You’ll always receive our decision in writing.

The letter will tell you either:

- that you’re exempt and clearly set out what your obligations are

- why you’re not exempt and that you can appeal

You should continue filing VAT Returns the way you usually do if:

- you’re waiting for HMRC to make a decision on an exemption request or an appeal after being rejected for exemption

- HMRC have told you that you’re exempt from Making Tax Digital

Your rights and obligations

Read the HMRC Charter to find out what you can expect from us and what we expect from you.

Help us improve this notice

If you have any feedback about this notice email: [email protected].

You’ll need to include the full title of this notice. Do not include any personal or financial information like your VAT number.

If you need general help with this notice or have another VAT question you should phone our VAT: general enquires helpline or make a VAT enquiry online.

Putting things right

If you’re unhappy with our service, contact the person or office you have been dealing with. They’ll try to put things right.

If you’re still unhappy, find out how to complain to HMRC.

How we use your information

Find out how HMRC uses the information we hold about you.

Updates to this page

Published 26 September 2013Last updated 18 March 2024 + show all updates

-

The reason for any zero rate or exemption has been removed from the list of details you must include on a VAT invoice.

-

Guidance has been updated to make it clear that you must keep digital records and submit returns using software.

-

This page has been updated because the Brexit transition period has ended.

-

First published.