Report foreign tax credit relief

Find out how to report foreign tax credit relief and complete your return if you're an employer.

Before making a report, you must apply to operate foreign tax credit relief.

To report foreign tax credit relief under your Appendix 5 arrangement, you must complete and return the form after 5 April of the year you’re claiming for.

What you’ll need

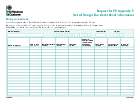

You’ll need to download and complete the form, and include the following details:

- employee’s name and date of birth

- employee’s National Insurance number

- name of your company and PAYE (Pay As You Earn) reference

- employee’s total earnings for the tax year

- amount of UK tax deducted from the employee’s earnings

- which countries the employee worked in during the last tax year

- the amount of foreign tax paid

- amount the employee earned while working abroad

Email HMRC to ask for the form in Welsh.

You should keep copies of your reports for at least 4 years.

Where to send the form

Appendix 5 Team

PAYE and Self Assessment

HM Revenue and Customs

BX9 1AS