Submit a wine, cider and other fermented products duty return

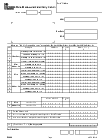

Submit a return (EX606) to declare duty on wine, cider and other fermented products (formally made-wine) each month.

When you should submit a return

HMRC must receive your return no later than the 15th day of the month following the end of your accounting period.

If the 15th day of the month falls on a weekend or public holiday, we must have your return by the last working day before that date.

You should submit a return even if your duty liability is nil.

When the rate changes during an accounting period, you must fill in 2 separate returns for the period. You should mark your returns pre or post budget.

Before you start

You can read guidance on how to complete your return in:

- section 7 of Cider production in the UK (Excise Notice 162)

- section 7 of Wine production in the UK (Excise Notice 163)

What you need

You’ll need:

- company name

- address

- unique reference number (URN)

- return period

- your Small Producer Relief rates if eligible for the relief

- details of the products eligible for the reduced draught rate

You can find tax type codes and rates for Alcohol Duty in UK Trade Tariff: excise duties, reliefs, drawbacks and allowances.

How to submit your return

Email HMRC to ask for this form in Welsh.

Submit your return using Dropbox

If you have access to a scanner, you can ask to submit your return by Dropbox.

Each month your need to:

-

Read the Dropbox protocols.

-

Send an email confirming you accept the protocols to HMRC payments Climate Change and Alcohol Duties at [email protected]

We’ll then reply and let you know what to do next. Do not send a return until we ask you to.

Submit your return by post

You should print, complete and post your form to:

HMRC payments Climate Change and Alcohol Duties

HM Revenue and Customs

BX9 1XL

For any queries, contact the Wine or Cider Duty payment and returns helpline.

Using print and post can take longer for us to process.

What to do next

Find out how to pay wine or cider duty.

If the products are placed in an excise warehouse

You must pay the duty and tell HMRC using either:

- the Alcohol and Tobacco Warehousing Declarations (ATWD) online service

- form W5 remittance advice for alcohol goods when paying by cash or equivalent

- form W5D deferment advice for alcohol goods when HMRC has approved your deferment request

Updates to this page

Published 1 August 2023Last updated 7 August 2024 + show all updates

-

The email address in the 'Submit your return using dropbox' section has been updated.

-

Welsh translation added.

-

A new version of the EX606 has been added. The guidance has been updated for the changes to Alcohol Duty from 1 August 2023.

-

First published.